Matchless Info About How To Learn To Prepare Taxes

To do this, you’ll need to review the irs’s standards for becoming an approved ce provider, apply online, and pay an annual fee (which is currently $460).

How to learn to prepare taxes. If you know how to prepare basic tax returns and want to continue to advance in your career, the advanced tax preparation course by national tax training school is a great. For starters, check out the tax. Calculate over 1,500 tax planning strategies automatically and save tens of thousands.

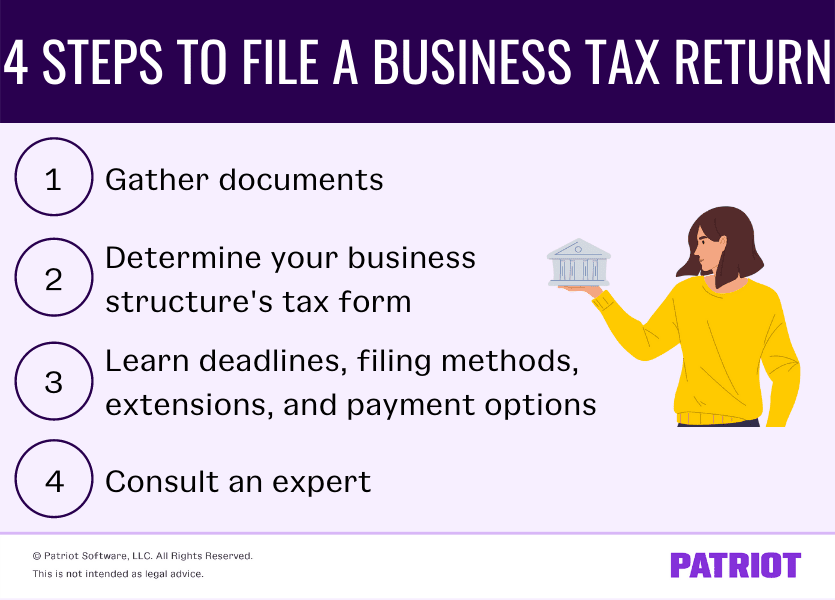

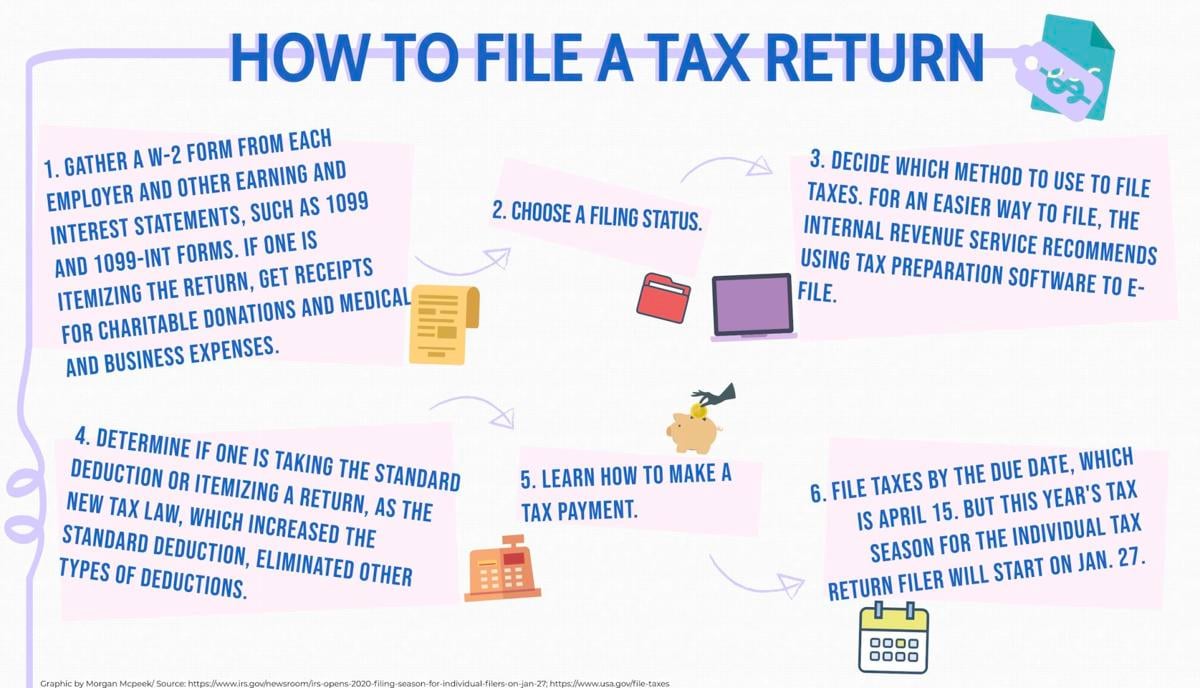

You have the freedom to choose which activities and methods of instruction work best to meet the. Students will learn about a range of tax and financial topics, including how to prepare personal and business tax returns. Learn all about tax preparation.

File with deluxe for only $6.99 and we'll send you to the front of the line if you have questions, assist you if you're audited, and give you unlimited amended returns. A beginners guide to taxes. Help your community in preparing taxes free of charge by becoming a volunteer with the volunteer income tax assistance (vita) or tax counseling for the elderly.

With the h&r block income tax course, you can learn how to prepare taxes like a pro go to disclaimer for more details 160. Get a ptin and an. The good news is that you don’t need to have a bachelor’s degree to become a tax.

Max out your ira contributions. Study to sit for the national bookkeepers association tax certification exam. Ad save money on taxes.

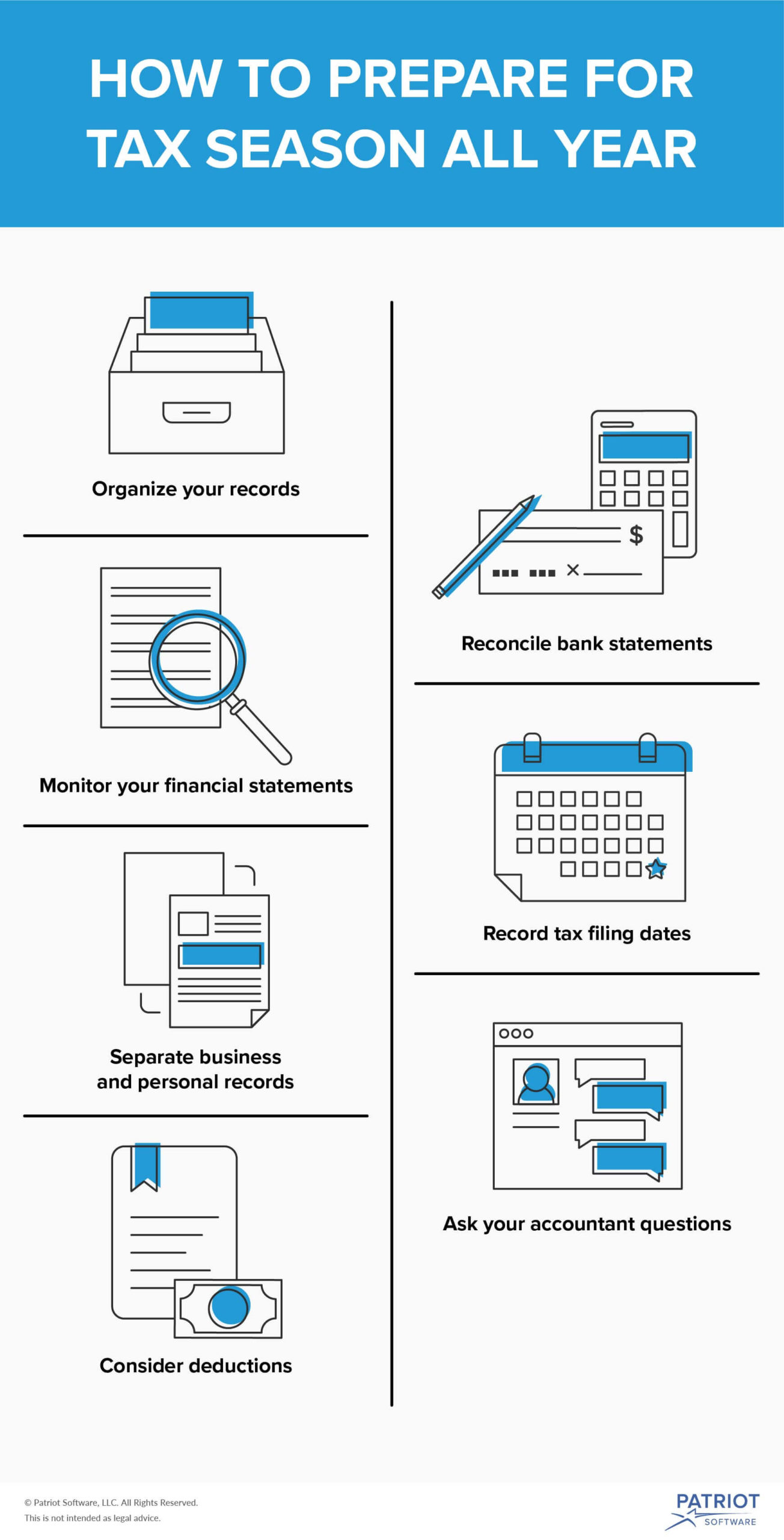

The free irs tax course is provided to you for free by platinum tax school, a leader in tax return preparer education and will introduce you to information you need to. Obtain forms and schedules from the. Understanding taxes can be customized to fit your own personal teaching style.